Compliance Officer Welcome Center

Compliance Officer

Welcome Center

IBKR offers EmployeeTrackSM, a solution for monitoring employee trading risk.

This page provides information and resources to help you monitor the global trading activity of employees from over 200 countries and territories.

Getting Started

Compliance Portal is our free tool for managing your EmployeeTrackSM Compliance Program. This program provides a simple, cost-effective solution to monitor employee personal brokerage account activity.

Employees can access stocks, options, futures, currencies, bonds and funds on over 150 markets in 34 countries from a single unified platform. Our Stock Yield Enhancement Program, provides employees with an opportunity to earn extra return by lending their fully paid shares to IBKR. Additionally, our Lowest margin rates and IB SmartRoutingSM helps support best execution by searching for the best available prices for stocks, options and combinations across exchanges and dark pools.

Configuring Your Account

User Access Rights

Grant access to compliance officers across offices and regions within your organization.

Dashboard

View, search, and manage employee accounts from a single, easy-to-use dashboard and invite employees to open IBKR accounts.

Reporting

Access employee statements and trade confirmations to review personal brokerage account activity. Generate reports by symbol, trade count, or account equity.

Pre-Trade Compliance

Implement trade restrictions, sanctioned security lists, blackout windows, and minimum holding periods. Restrict trades by product type, sector, industry, issuer, or symbol.

User GuideData Feeds

IBKR provides a data feed to EmployeeTrackSM Compliance Officers who want to integrate their data with third-party software.

We provide data feeds for the following third-party software:

- ACA ComplianceAlpha

- Ascendant Compliance Manager

- BasisCode (via Electra)

- ComplySci

- Evare

- FIS Employee Compliance Manager (Formerly PTA)

- IQ-EQ (Formerly Greyline)

- MyComplianceOffice (MCO)

- MyComplianceOffice Compliance Technologies (MCT)

- Orical

- Paragon Data Labs (via Electra)

- StarCompliance

- Wolters Kluwer CCH

Structure

EmployeeTrackSM provides a simple, cost-effective solution for organizations such as exchanges, hedge funds, mutual funds, brokers, banks, insurance companies, law firms, accounting firms and consulting firms who are required to monitor their employees' trading activity.

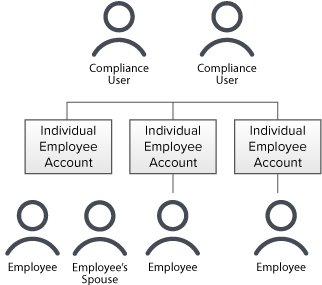

Compliance Officers can appoint one or more compliance employees to administer employee accounts any time after the application is complete. These compliance employees can access multiple individual, joint, trust and IRA employee accounts for the purpose of monitoring trading activity.

Accounts are accepted from citizens or residents of all countries except citizens or residents of those countries or regions that are on the sanction list of the US Office of Foreign Asset Controls or similar lists, or other countries determined to be higher risk. Click here for a list of available countries.

Support Resources

Frequently Asked Questions

Looking for an answer? Browse our extensive inventory of frequently asked questions.

Global Product Offering

Invest globally in stocks, options, futures, currencies, bonds and funds from a single unified platform.

Margin Trading

IBKR offers margin rates from USD 5.83% - 6.83%, the lowest margin loan interest rates of any broker, according to the StockBrokers.com Online Broker Survey 2023 Read the full article.

Support for Institutions

Browse our support page for instructional videos, user guides, release notes and information on connecting with us.