Trade Crypto for Less Coin

PRODUCTS

Trade Crypto for Less Coin

The IBKR Advantage

- Low commissions – Just 0.12% to 0.18% of trade value1 with no added spreads, markups or custody fees

- Trade and hold Bitcoin, Bitcoin Cash, Ethereum, Litecoin and Solana.

- Additional features let clients hold USD and cryptocurrencies in their cryptocurrency trading account, trade cryptocurrencies 24/7, place non-marketable limit orders, and withdraw cryptocurrency assets from your Paxos account to an external wallet.

- Invest in crypto, stocks, options, ETFs, futures, bonds, and more from a single unified platform

- Cryptocurrency trade execution and custody are provided by Paxos Trust Company.

- IBKR Rated Best Online Broker – 2025 Broker Chooser Best Online Brokers2

Low Commissions

0.12% to 0.18% of Trade Value1

with No Added Spreads, Markups or Custody Fees

While other crypto exchanges and brokers charge trading fees as high as 2.00% of trade value or more, and add spreads or markups to the cryptocurrency price, cryptocurrency trading with Paxos on Interactive Brokers’ platform has a low commission of just 0.12% to 0.18% of trade value1 with a USD 1.75 minimum per order (but the minimum is subject to a cap of 1% of trade value). Plus, there are no added spreads, markups, or custody fees.

Crypto Trading Cost Comparison3

| Fee | IBKR | Gemini ActiveTrader4 |

Robinhood Crypto5 | Fidelity Crypto6 | eToro7 | Coinbase Advanced8 |

|---|---|---|---|---|---|---|

| Crypto Transaction Fee for $1,000 of crypto |

0.18% | 0.40% | None | None | 1.00% | 1.20% |

| Spread / Markup | None | None | 0.85% | 1.00% | None | None |

| Total fee | 0.18% | 0.40% | 0.85% | 1.00% | 1.00% | 1.20% |

| Cost of $1,000 trade | $1.80 | $4.00 | $8.50 | $10.00 | $10.00 | $12.00 |

Discover a World of Investment Opportunities

Clients can trade cryptocurrencies through Paxos alongside global stocks, options, futures, spot currencies, bonds, funds and more via the Interactive Brokers platform.

- Commissions just 0.12% to 0.18% of trade value

- Trade and hold BTC, BCH, ETH, LTC and SOL

- USD 1.75 minimum per order, capped at 1% of trade value

Additional Features

- Hold USD in your cryptocurrency account

- Trade cryptocurrencies 24/7 when you transfer funds to your dedicated Paxos account during normal US banking hours.

- Place non-marketable limit orders

What is Cryptocurrency?

Cryptocurrency is a type of digital or virtual currency that exists only online. It uses mathematical algorithms and encryption techniques known as cryptography to secure transactions and manage the network. Unlike traditional fiat currencies issued by governments, cryptocurrencies are decentralized and operate on blockchain technology, which is a distributed ledger that records all transactions across a network of computers.

Key features of cryptocurrency include:

- Digital-only

No physical coins or bills. - Decentralized

Most cryptocurrencies are not controlled by a central authority like a bank or government. - Blockchain-based

Transactions are recorded on a transparent and secure ledger. - Cryptographic security

Ensures the integrity of transactions and ownership. - Pseudonymous

Users are identified by digital addresses, not personal names (though not fully anonymous).

Key Cryptocurrency Terms

As an emerging asset class, there are key terms associated with cryptocurrency that you should know:

- Bitcoin: The first and most popular cryptocurrency.

- Blockchain: A digital record book that keeps track of all cryptocurrency transactions. It is shared across many computers, so it is hard to change or hack.

- Wallet: A software program or physical device that stores your cryptocurrency. It lets you send and receive digital coins.

- Private Key: A secret code that gives you access to your cryptocurrency. You must keep it safe and never share it.

- Public Key: A code that works like your digital address. People use it to send you cryptocurrency.

- Mining: The process of using computers to solve puzzles that confirm transactions and add them to the blockchain. People who do this are called miners, and they earn new coins as a reward.

- Exchange: A website or app where you can buy, sell, or trade cryptocurrency using regular money or other digital coins.

- Token: A type of cryptocurrency that is built on another blockchain. Many tokens are used in apps or games or represent things like points or access rights.

- Ethereum: A popular cryptocurrency that lets people create smart contracts and apps that run on the blockchain.

- Smart Contract: A digital agreement written in code. It runs automatically when certain conditions are met.

- NFT (Non-Fungible Token): A special type of digital asset that shows ownership of a unique item, like art, music, or video.

- DeFi (Decentralized Finance): Financial services that work without banks or middlemen. These are built using blockchain technology.

- Gas Fee: A small amount of cryptocurrency you pay to process a transaction or run a smart contract on a blockchain like Ethereum.

- Altcoin: Any cryptocurrency that is not Bitcoin. Examples include Ethereum, Litecoin, and Solana.

- Stablecoin: A type of cryptocurrency that is linked to the value of a real-world asset, like the US dollar. It is made to be less risky and more stable in price.

- Ledger: A record of all transactions. In cryptocurrency, the ledger is digital and usually takes the form of a blockchain.

- Satoshi: The smallest unit of Bitcoin. One Bitcoin equals 100 million satoshis.

- ICO (Initial Coin Offering): A way for new cryptocurrency projects to raise money by selling their coins to investors before launch.

- HODL: A slang term that means to hold on to your cryptocurrency instead of selling it, even when prices go up or down.

How Do I Buy Cryptocurrency?

To purchase cryptocurrency, open an account with a trusted cryptocurrency exchange or an online broker like Interactive Brokers who offers access to cryptocurrency. Once your account is open and funded, you may have to request trading permissions for trading cryptocurrencies and virtual assets products. Choose a cryptocurrency to buy, enter the amount you wish to invest, review commissions and fees, and place your order.

After purchasing your cryptocurrency, you could store it by keeping it on the exchange used to purchase it or transfer it to a crypto wallet.

What Are the Benefits and Risks of Trading Cryptocurrency?

Benefits of Cryptocurrencies

Cryptocurrency offers several benefits to users and investors. It provides the potential for high returns and allows people to access financial markets without needing a traditional bank account. Crypto trading is available 24 hours a day, so investors can buy or sell at any time. Many cryptocurrencies also allow for fast, low-cost transfers across borders. People who buy cryptocurrency often enjoy greater control over their funds and more privacy than with standard banking. In addition, crypto can help diversify a portfolio and support new technologies such as smart contracts and decentralized apps.

Risks of Cryptocurrencies

While cryptocurrency can be rewarding, it also comes with serious risks. Prices can change quickly, which means there is a chance of losing a large portion of your investment. Because the market is still developing, crypto is less regulated than traditional financial systems, which increases the risk of fraud or scams. Some platforms have been hacked, and users who lose their private keys may lose access to their funds permanently. Also, government policies can affect how crypto is taxed or allowed to be used, adding uncertainty for buyers. Like any investment, it is important to understand the risks before getting involved.

Interactive Brokers’ Education and Resources for Cryptocurrencies

Traders’ Insight

Traders’ Insight provides market-related articles and commentary from Interactive Brokers’ employees, exchanges and third-party contributors.

IBKR Webinars

Participate in an upcoming webinar or review previous webinars regarding cryptocurrency.

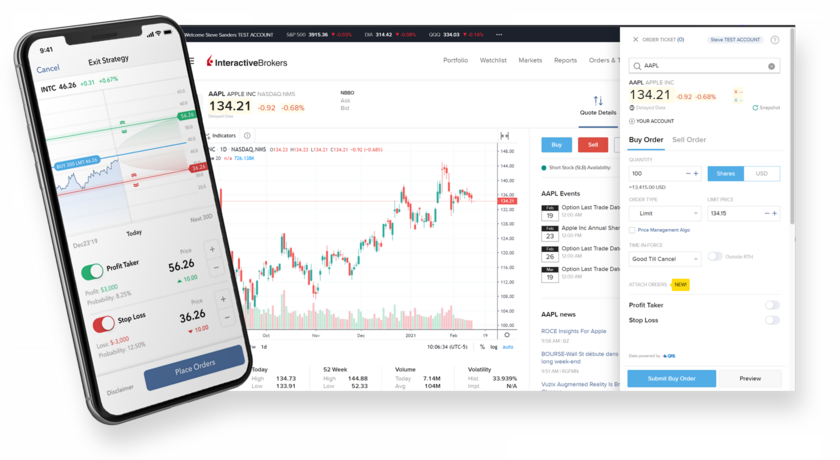

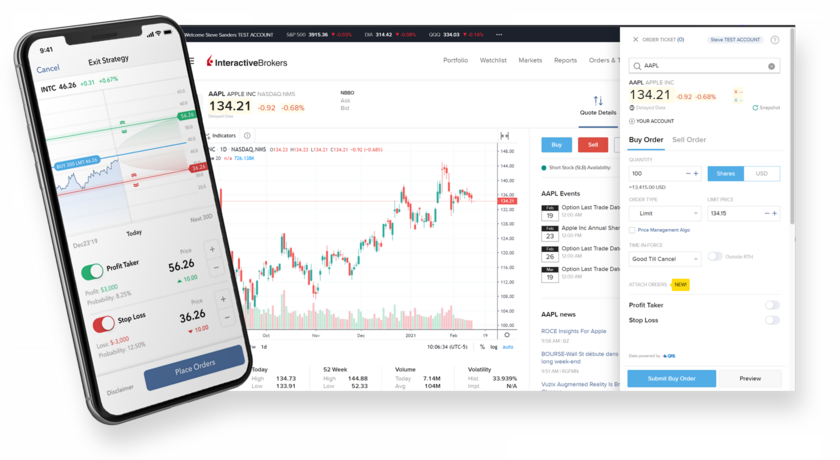

Professional Trading Platforms and Tools

Trading Platforms

Powerful, award-winning trading platforms and tools for managing your portfolio. Available on desktop, mobile, and web.

Trading Tools

Use a full suite of professional trading tools to help make better decisions and manage your portfolio. Spot market opportunities with Advanced Market Scanners and analyze your portfolio with Risk Navigator.

Security You Can Trust

Security is crucial to cryptocurrency trading. Use the IBKR platform and funds from your IBKR account to trade cryptocurrencies at Paxos Trust Company. As a Trust company, Paxos Trust Company is regulated and supervised by the New York Department of Financial Services (the New York bank regulator). Cryptocurrencies are not regulated in the UK.

Interested in Trading Crypto?

IBKR Clients –

Log in to Request Cryptocurrency Trading Permissions

Log in to Client Portal and click the User ("Head/Shoulders" icon) > Settings menu. From the Settings page, click Trading Permissions to request Cryptocurrency trading permission.

Trading permission requests are typically approved overnight.

New Client? Open an IBKR Account

FAQs

Disclosures

-

- Capital gains tax may apply.

- Neither IBUK nor any of its affiliates are party to any transactions in digital assets and do not custody digital assets on your behalf. Paxos Trust Company LLC ("Paxos") is your counterparty to any transactions in digital assets, and any positions in digital assets are custodied solely with Paxos and held in an account in your name outside of IBUK. Paxos is a New York Limited Trust Company and is regulated by the NY Department of Financial Services.

- Digital assets held with Paxos are NOT protected by the Financial Services Compensation Scheme (FSCS) or the U.S. Securities Investor Protection Corporation (SIPC). Cryptoassets are not subject to regulation beyond anti-money laundering requirements.

- Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. For more information about the risks surrounding the trading of Digital Assets, please see the "Disclosure of Risks of Trading Digital Assets".

- For more information about eligibility to trade digital assets with Paxos, please see the FAQ.

- Depending on client monthly volume, with a USD 1.75 minimum commission per order (but the minimum is subject to a cap of 1% of trade value).

- For more information, see our awards page.

- All rates as of September 22, 2025. Competitor rates and offers are subject to change without notice. Services vary by firm.

- Gemini ActiveTrader Taker Fee.

- Robinhood Crypto spread added to crypto price.

- Fidelity Crypto spread added to crypto price.

- eToro has a 1% fee for trading cryptocurrencies, which is added to the market price.

- Coinbase Pro Level Intro 1 Taker Fee.