Contracts for Difference (CFDs)

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 59.6% of retail investor accounts lose money when trading CFDs with IBKR. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

PRODUCTS

Trade Contract for Difference (CFDs)

The IBKR Advantage

- Transparent, low commissions and financing rates

- Trade CFD Shares, Index, Metals and Forex virtually around the clock

- Margin requirements generally more favorable than those of shares

Key Information Documents for IBUK CFDs (KID)

IB Share CFDs

Over 8,500 Share CFDs available to trade globally. Trade US Share CFDs during extended hours and overnight.

Additional benefits include:

Transparent, Low Commissions and Financing Rates

Commissions start at 0.5 cents per US share and 0.05% on all other share CFDs, with lower rates available for active traders. Overnight financing charges start at benchmark +/-1.5%, with lower spreads available for larger balances. You will find these rates highly competitive. In addition, UK Stamp Duty, French FTT and Spanish FTT are not payable for CFD transactions.

Trade CFDs on Restricted US ETFs

A Key Information Document is required for European retail investors, which US ETF issuers do not provide. As a consequence, US ETFs cannot be traded by EEA and UK residents. They can however be traded as CFDs.

Margin Efficiency

CFD margin requirements are generally more favorable than stock margin requirements. Retail clients are subject to a minimum regulatory initial margin of 20%. Additional details are available in IBUK Margin Requirements.

Efficient CFD Reference Pricing

Share CFD pricing reflects the exchange-quoted price for the underlying share. IBKR uses its IB SmartRoutingSM technology to determine the CFD reference price. Clients can add quotes to the exchange book in the same way they would trading stocks because IBKR immediately matches all CFD orders with a hedge-order so that a non-marketable CFD order creates a matching non-marketable order for the underlying share on the exchange.

IBKR Share CFDs FAQs

FAQs: IBKR Share CFDs

IB Index , Crude Oil and Metals CFDs

Gain broad market exposure more easily than with many other financial products. Additional benefits include:

Flexible Exposure to Global Markets

Index CFDs are available for all major equity market indices , US and UK Crude Oil and Precious Metals (London Gold and Silver). Most equity indices , oil contracts and metals are tradable 23 hours. Equity indices can be traded in lots as small as 1X the index level. Unlike the related futures, Index CFDs do not expire, saving rollover related costs and risks.

Transparent, Low Commissions and Financing Rates

Index and Crude Oil CFD quotes show spreads and ticks that reflect those of the underlying future, plus an additional spread added by our liquidity provider. Precious Metals spreads equal those of the related cash market. IBKR charges a commission rather than further widening the spread.

Depending on the index, commission rates are only 0.005% - 0.01%. Commissions are only 0.015% US and UK Crude Oil, 0.015% for Gold and 0.03% for Silver. Overnight financing rates for equity index CFDs and Precious Metals are just benchmark +/-1.5%. Overnight financing does not apply to the Crude Oil CFDs as they reference perpetual rolling futures.

Margin Efficiency

Index CFDs are margined at the same low rates as the related future, adjusted for contract size. Retail clients are subject to minimum regulatory margins of 5% or 10% depending on the index or metal.

IBKR Index CFDs FAQs

FAQs: IBKR Index CFDs

Forex CFDs

Gain exposure to currencies around the clock more easily than with many other financial products. Additional benefits include:

Direct Access to Interbank Quotes

Real-time prices from 19 of the world's largest FX dealing banks, plus a transparent, low commission that avoids the conflict of interest of FX platforms which deal for their own account.

ECN-Like Market Structure

Our order book allows you to set orders away from or between the markets. Trade with other IBKR clients, as well as with the liquidity-providing banks.

IBKR Forex CFDs FAQs

FAQ: IBKR Forex CFDs

Automatic Overnight Position Rolls

For positions held overnight, IBKR applies a straightforward interest credit or charge based on the difference in the benchmark rates for the two currencies and a low IB spread.

FX Trader

Trade Forex CFDs in our optimized FXTrader, which includes real-time streaming quotes, up and down indicators, trading volumes, pending trades, executions, positions, and average price plus P&L.

Powerful CFD Trading Tools

FXTrader

The FXTrader provides an optimized trading interface with IBKR-designed tools to trade the currency markets.

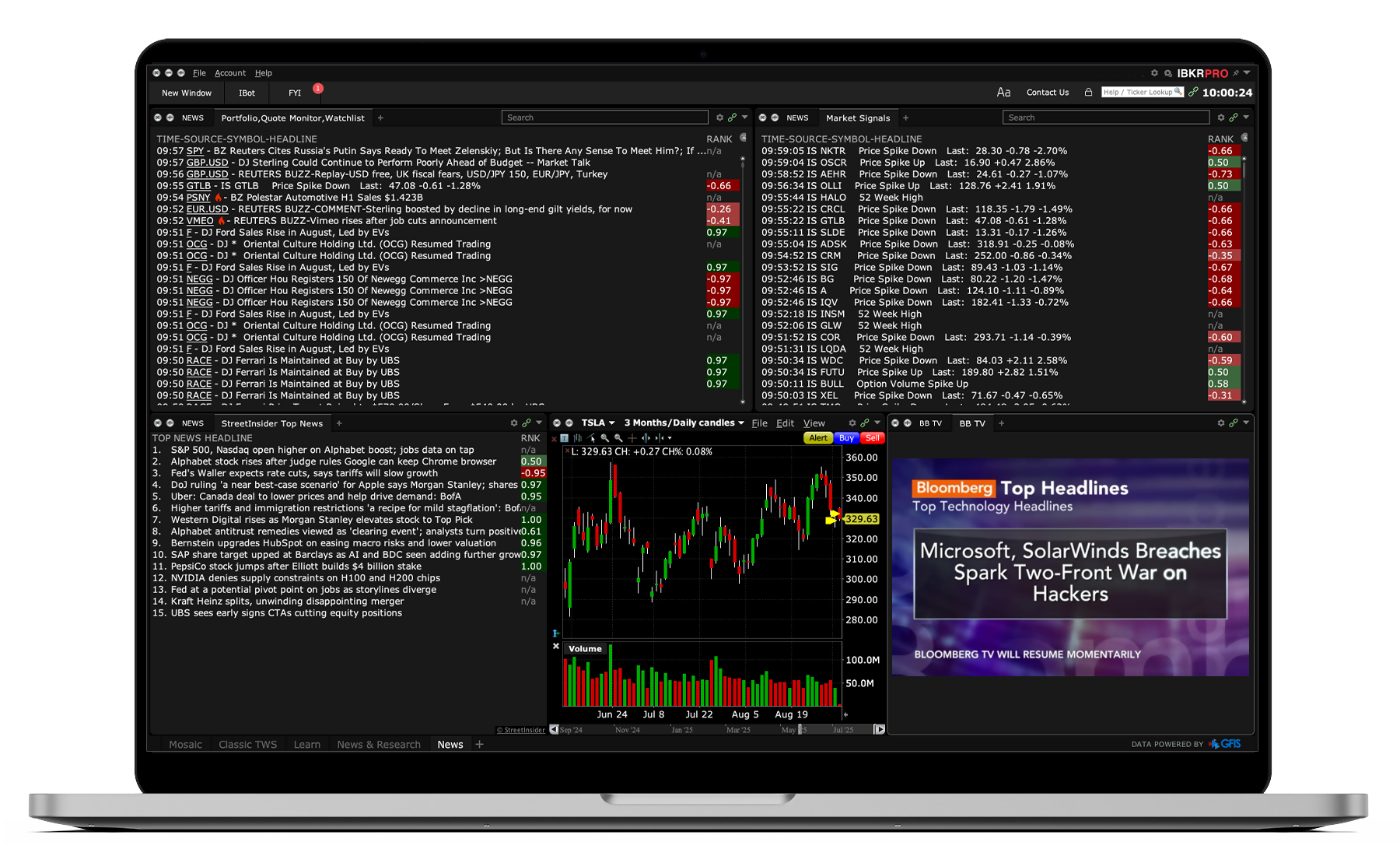

Trader Workstation (TWS)

Our flagship desktop platform designed for active traders and investors who trade multiple products and require power and flexibility.

IBKR Mobile

Easily trade and monitor your IBKR account on-the-go from your iOS or Android device (tablet or smartphone).

What are Contracts for Difference?

Contracts for Difference, or CFDs, let you trade on the price movements of stocks, indices, forex, commodities, and more without owning the actual asset.

You can choose to buy if you think the price will go up or sell if you think it will go down. CFDs are flexible tools that give you access to a wide range of global markets and often allow you to use leverage, which means you can control a larger position with a smaller investment. Instead of buying the asset itself, you trade based on the difference between the opening and closing prices of the position.

How Do I Buy CFDs?

Getting started with CFDs is straightforward. First, open an account with a trusted broker like Interactive Brokers, which offers access to a wide range of global markets and competitive pricing. Once your account is set up, add funds using your preferred payment method. Next, choose the asset you want to trade, such as a stock, index, currency pair, or commodity. If you believe the price will go up, you can buy a CFD. If you think the price will go down, you can sell a CFD. Decide how much you want to trade and, if available, adjust your leverage to control a larger position with a smaller investment. To help manage your risk, you can set optional tools like stop-loss or take-profit orders. After placing your trade, you can monitor the market and close your position at any time.

What Are the Benefits and Risks of Trading CFDs?

CFDs offer both potential rewards and risks. On the reward side, CFDs let you take advantage of rising or falling markets without owning the actual asset. They give you access to global markets and often allow you to use leverage, which means you can control a larger position with a smaller amount of money. However, the risks can be significant. Leverage can increase your losses just as quickly as it can increase your gains. If the market moves against you, you may lose more than your initial investment. CFDs also carry costs such as spreads and overnight fees, and fast-moving markets can make it hard to react in time. Because of these risks, CFDs may not be suitable for everyone, especially new or inexperienced traders.

Interactive Brokers’ Education and Resources for CFDs

Traders’ Academy

Access free online courses that cover the concepts and tools of financial trading. Whether you are an active trader, investor, educator or student, we offer engaging lessons utilizing our award-winning trading tools. Read notes and quizzes to help reinforce each lesson.

IBKR Podcasts

Stay up to date with financial and macroeconomic events by subscribing to the IBKR Podcast channel by Interactive Brokers. Audio market commentary draws upon an array of industry experts to get unique insight on a variety of topics and asset classes. Episodes include discussions with researchers, leading financial services companies and veterans from the financial field.