Allocation Order Tool

IBKR Allocation Order Tool

Streamlined Trade Allocation for Advisors

The IBKR Advantage

- Quickly enter trade allocations across some or all client accounts from a single screen

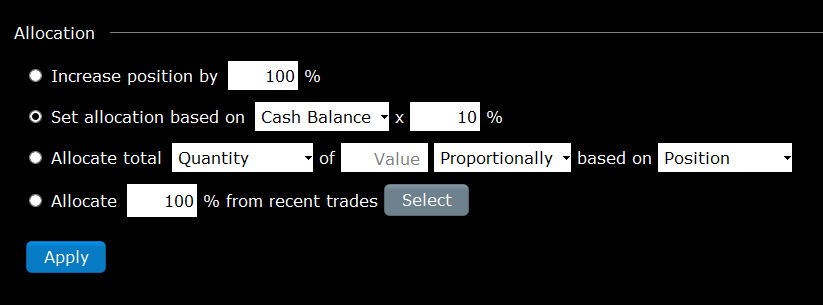

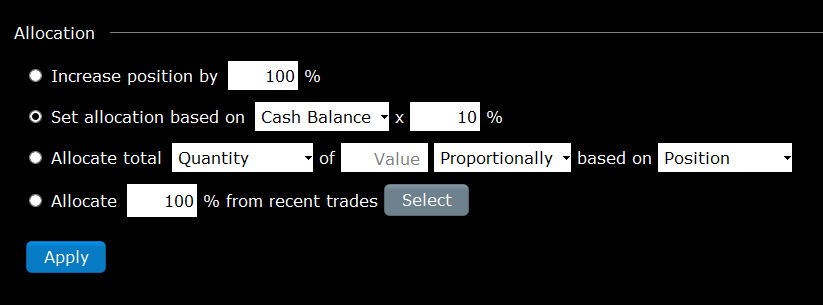

- Increase or decrease positions by specific percentages

- Set per-account allocations by cash balance or buying power

- Scan client accounts invested in a particular security and filter by position size, market value, percent of P&L, cash balance or buying power

- Allocate the total quantity or cash quantity for each client, either equally or proportionally by position, cash balance or buying power

- Create and save multiple allocation profiles

- Modify orders and allocations on the fly

- Modify group rebalance orders and see post-trade values before submitting the order

- Use the Tax Harvesting feature to help manage capital gains taxes

Interactive Brokers’ Trader Workstation (TWS) offers an integrated Allocation Order Tool that streamlines the creation, execution and allocation of group orders for all or selected clients. Advisors can group client accounts and develop bulk orders in minutes, using strategies that quickly capitalize on time-limited market opportunities.

The Allocation Order Tool also includes IBKR's Tax Loss Harvesting, which helps advisors optimize any tax benefits from capital losses and distribute the losses across affected accounts.

Learn more about our advisor solutions

USER GUIDES

Get Started with the Allocation Order Tool

For more information on using the Allocation Order Tool, select your trading platform.

Disclosures

The projections or other information generated by Tax Loss Harvesting regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

The information provided here is not intended to serve as tax advice and should not be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local, or other tax statutes or regulations. It is also important to acknowledge that this information cannot be relied upon to resolve any tax issues.