Invest for Your Future with a Stocks and Shares ISA

Invest for the Future with a Stocks and Shares ISA or Junior ISA (JISA)

The IBKR Advantage

- No Custody or Transfer Fees: There are no custody fees for overnight or long-term investments, and no fees to transfer your account from another broker.

- Low Commissions: Our commissions start1 from just £3/€3 per trade for the UK and most European stocks, while US stocks start from just USD 0.005 per share. For mutual funds, commissions range from nil to £4.95 (for GB funds). We ask for EUR 4.95 for EUR-denominated funds or the equivalent conversion in GBP.

- Low Currency Conversion Fees: Transparent low FX conversion commissions (e.g., 0.03%), and tight spreads and deep liquidity.

- Earn Interest: Earn interest on instantly available cash balances.

- Global Diversification: Invest in a broad range of global markets, including multi-asset classes such as stock/shares and mutual funds, using comprehensive tools such as GlobalAnalyst and Mutual Fund/Bond Search to find opportunities for global diversification.

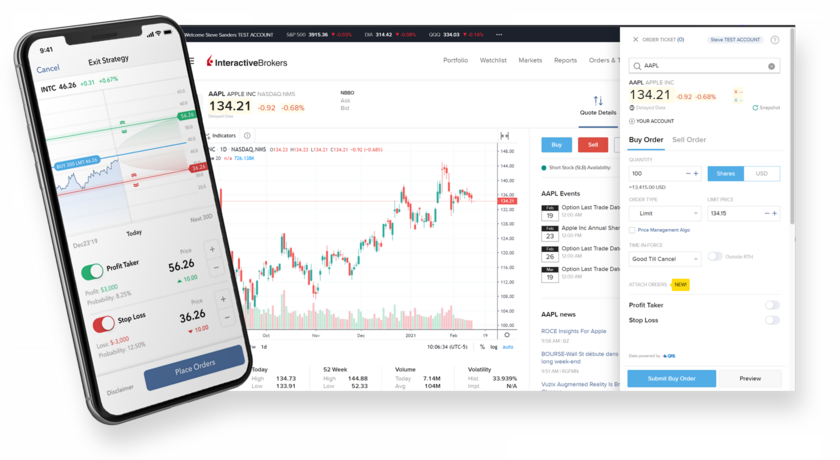

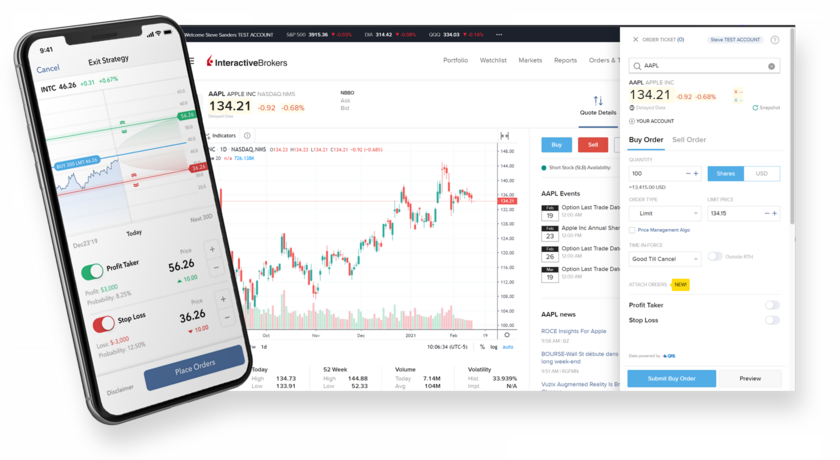

- Mobile Trading: Trade through our simple to use smartphone App, available on iPhone and Android.

- Fast, simplified portfolio transfer from other brokers to IBKR: Transfer your assets as-is if we support the asset classes you’re invested in, without the cost of cashing in first.

- Single Sign-On: Easily access and invest in your IBKR General Investment Account (GIA) and ISA (optional) with a single sign-on.

- Powerful Trading Tools: Our trading platforms offer features to meet the needs of both the occasional investor and active trader.

- Account Protection: In the unlikely event that IBUK became insolvent, an administrator would be appointed to return your money/assets to you. If there is any shortfall, eligible claims will be covered by the UK Financial Services Compensation Scheme (“FSCS”). The FSCS is an independent body set up by the UK Government to pay compensation if a UK firm, such as IBUK, is in default and cannot meet any valid claims against it. FSCS claims are limited to £85,000 per client. Please note, the FSCS applies to designated investments and may not cover all investments or transactions (and in particular these protections don’t apply to investment losses). For more information on the FSCS see: www.fscs.org.uk.

Get Started Today

UK Tax rules apply. Tax treatment depends on your individual circumstances and may change

Stocks and Shares (adult) ISA

If you are a U.K. resident for tax purposes and at least age 18, you can open a Stocks and Shares Individual Savings Account (ISA). ISAs offer a tax-efficient opportunity to save up to £20,000 in each tax year (April 6 to April 5). By HMRC rules (subject to change), income earned is tax-free, as are any gains when you sell your investments.

There is no minimum deposit needed to open an ISA account although you must fund your account in GBP, as mandated by HMRC ISA rules.

Stocks and Shares (junior) JISA

Our Junior ISAs function similarly to our Stocks and Shares ISA, but is intended for those under age 18. The maximum investment for a Junior ISA in the tax year is £9,000. If you are the parent or guardian of a junior (under the age of 18 years of age), you can open a Junior ISA for them and then anyone can contribute to the JISA. JISA contributions are tax-free and can hold a broad range of financial products.

More Information about ISA Accounts

More Information about JISA Accounts

Open an ISA Account

Simple Investing, Simple Pricing.

£3 / €3 per trade for Western European stocks, with no added spreads, account minimums or platform fees.1 These simplified commission rates are available with IB SmartRoutingSM, which optimizes the execution quality for clients by accessing the many exchanges and trading venues across the continent.2 Pricing on US stocks starts at just USD 0.005 per share.

There is a minimum monthly activity fee of £3 for a Stocks and Shares (adult) ISA and £1 for a JISA. You receive one free withdrawal per month and there are no custody fees for all account types. All ISA accounts are cash only, no margin.

Learn About Commissions

Global Diversification

An IBKR ISA account provides access to global markets and tools like GlobalAnalyst help you find opportunities for international portfolio diversification. Use GlobalAnalyst to discover undervalued companies that may have greater growth potential and compare the relative value of stocks by region, country, industry or individually, and display metrics in one of 27 currencies.

Please note that past performance is not a reliable indicator of future results, in addition forecasts are not a reliable indicator of future performance.

Try GlobalAnalyst

Trade from Your Device

Stay connected to markets at home or while on the go with the IBKR Mobile App or access our Client Portal for one-stop trading, cash management and account services. For advanced investors, we also offer access to our Trader Workstation (TWS) trading platform and APIs.

Learn About Trading Platforms

Open an ISA Account

Disclosures

- Interactive Brokers (U.K.) Limited is an approved HM Revenue & Customs Individual Savings Account (ISA) Manager - reference: Z2056.

- UK Tax rules apply. Tax treatment depends on your individual circumstances and may change

- For larger trades (those over £6000 / €6000) the cost is 0.05% of trade value.

- More information regarding IB SmartRoutingSM is available on our website.