TWS Release Notes

These release notes document the major enhancements and bug fixes distributed in the current TWS version 938.

Chart Enhancements

The "Factory Default Settings" for charts has been changed to the following:

- The default chart type is set to daily automatic candles, two days/five minute bars.

- Hot buttons are off by default.

- The Bar Details Zone that is visible when you mouse over a bar now displays in the lower left corner of the chart. Use Global Configuration>Charts>Settings>Tool tips section to specify the data to display in the Zone. Choose from: Date/Time, High, Low, Close, Open, Volume, VWAP and Studies.

- The font size for the Quote Zone, Bar Details Zone and Axis labels is slightly larger

- A toggle to hide/display the Vertical Scrollbar has been added to Global Configuration>Settings.

In addition, empty bars in a chart (indicating there is no data) will display as gray for easier identification.

Post-Expiration Predicted Margin and Excess Liquidity

Two new fields have been added to the Account Information window:

- Post-Expiry Margin @ Open (predicted) - provides a projected "at expiration" margin value based on the soon-to-expire contracts in your portfolio.

- Post-Expiry Excess (predicted) - provides a projected "at expiration" excess liquidity value based on the soon-to-expire contracts in your portfolio.

These fields display values at expiration and are highlighted in red. All other times the value is "0". The projected values in these fields include the anticipated account value including the expiring contract. To see just the projected margin and excess liquidity values for the expiring contract, double click the entry in the Account Information window.

Mosaic Market Scanner Updates

The Mosaic Market Scanner now includes the First Trade Date field, which displays the IPO date or date that the contract was first available for purchase. Additionally, the regulatory imbalance fields (Reg Imbalance and Reg Imbalance%) have been enhanced to display better data and more helpful tooltip text.

To add fields to the Mosaic Market Scanners, select the scanner tab and click Edit Scanner in the top right corner of the scanner window. In the Fields and Filters section, click the "Add Field" drop-down list. Select First Trade Date from the Contract Description section and Reg Imbalance and Reg Imbalance% from the Auction section.

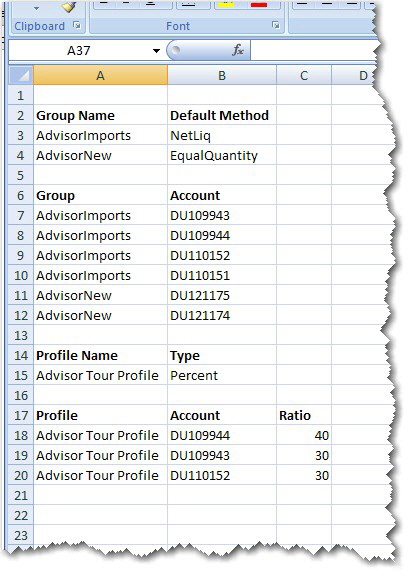

Import and Export .csv Account Groups and Allocation Profiles

Advisors and other multi-client account users can now export and import Account Groups and Allocation Profiles to and from an Excel .csv file.Arrange the file in four sections that define:

- The Account Groups

- The accounts that are members of each group

- The Allocation Profiles

- The accounts that are members of each profile.

The image above provides a sample layout for the import/export file. To create your own template, elect to "Export" a group or profile as a .csv, open the result in Excel, rename the file, and use the layout to create another Account Group or Allocation Profile to import.

Access the "Import" and "Export" buttons in Global Configuration in the Advisor section on the Account Groups and Allocation Profiles pages. Note that you can elect to import/export to either the CSV or the default XML format.

Updated "Close All Positions" Dialog Box

The Close All Positions dialog box was redesigned in release 937 to provide more flexibility when closing orders. In 938 the feature has been revised further to include a warning icon and to automatically remember your settings the next time you elect to "Close Positions." This feature is accessible from the Trade menu in Advanced Order Entry, the Account menu in Mosaic and from the right-click menu in the Portfolio section of the Account Information window.

Fixes and Changes

The following have been fixed or modified in TWS version 938:

- Support has been added to trade Hong Kong government bonds in TWS.