TWS Release Notes

These release notes document the major enhancements and bug fixes distributed in the current TWS version 936. Please note that you may have to refresh your current build to get new features and updates. To find out what version you are currently using, from the TWS Help menu select About Trader Workstation and scroll down to find the build number and date.

API: Receive Primary Exchange in Exchange Field

Because some third-party software doesn't support a separate field for sending the primary exchange, TWS will now support receiving the primary exchange in the exchange field. The syntax is: [exchange][separator][primary_exchange] where [separator] can be a colon (":") or a slash ("/"). For example, to request market data for MSFT, you could send the following in the exchange field: SMART/ISLAND. Note that TWS still supports receiving the primary exchange in the separate designated field.

Added in version 936.9n December 6, 2013

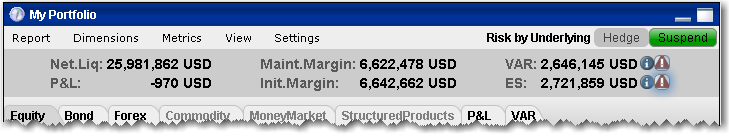

IB Risk Navigator Dashboard

The IB Risk Navigator now displays a Risk Dashboard that displays the account's Net Liquidation Value, total P&L, current Maintenance and Initial margin, VAR and Expected Shortfall (ES). You can hide and display the dashboard from the Risk Navigator View menu.

In addition we have added several new fields that can be displayed in various reports. Add fields from the Risk Navigator Metrics menu within a report. New Value columns include Price Change and Price Change%. New Contract Risk fields include Implied Volatility, Implied Volatility Change and Implied Volatility Change%, Historical Volatility, Historical Volatility Change and Historical Volatility Change%.

At the underlying level, Risk Navigator puts the values for the given underlying. In cases where this is not available (for example a commodity index without a price) it presents the value of the closest futures contract.At the futures level, Risk Navigator puts the proper values for the given futures.

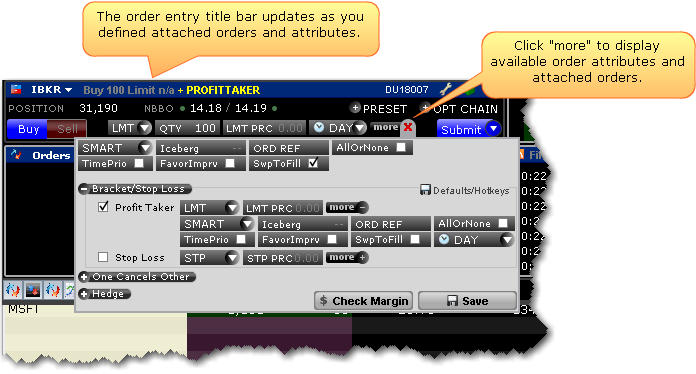

Support for Attached Orders in Mosaic

The "More" section of the Order Entry panel in the Mosaic has been significantly enhanced to support several of the more advanced order attributes and attached orders that were previously only available from the Advanced Order Management interface of TWS.

In addition to the Display (Iceberg), Order Reference and routing features, the Order Entry "More" command in the Mosaic now includes:

Attributes:

- All or None order attribute

Apply one or multiple attributes to an order by simply checking the attribute.

Attached Orders:

- Bracket and Stop Loss orders - Select Bracket/Stop Loss to display the inline editor. Select Profit Taker and/or Stop Loss and define the order parameters including adding order attributes. Choose the Default/Hotkeys icon to create default actions based on your specified order criteria, for example save your settings for all orders based on the current asset. You can go even further by defining a hotkey based on your order specifications, or setting up auto attach orders that will automatically attach the order type to the specified asset type or ticker-specific order.

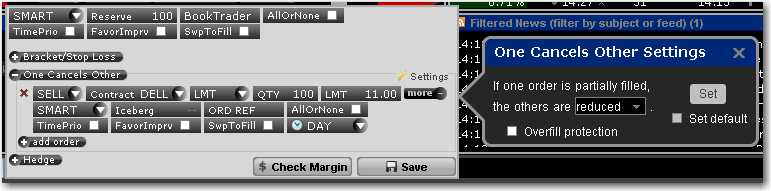

- One Cancels Other order - Select One Cancels Other to open the inline editor and define the "other" order or orders. Use the "Settings" icon to specify actions for partially filled orders. Use the "more" item within the One Cancels Other editor to apply an attribute. Click "add order" to add another order to the One Cancels Other order group.

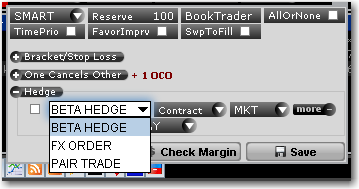

- Hedge orders (Beta, FX, Pair Trade, and Delta Hedge for option limit orders) - Select Hedge to open the inline editor and select a hedging order type. To attach and FX, Pair Trade or Delta hedge, click the Beta Hedge item and select from the drop-down list. Specify the hedging contract and other hedge order criteria.

When you attach an order and then submit, the parent-child relationship is graphical visible in the Orders panel. Additionally, you can now assign and use hotkeys within the Mosaic. Click the Default/Hotkeys icon while setting up an order to assign a hotkey shortcut.

Watchlist Cloud Sharing

You no longer need to worry about adding tickers to mobileTWS so that you can trade the same contracts in all mobileTWS and desktop TWS versions. mobileTWS now allows you to import Watchlist tickers that you added to TWS or mobileTWS on another device to your mobile Watchlist. Once you have enabled the latest versions of TWS (936) and mobileTWS, you can import Watchlists to mobileTWS using the "Import" feature in Configuration. Select one or multiple Watchlists to import. For changes to existing Watchlists, elect to overwrite the full page, or just append new tickers to the existing Watchlist.

This feature is currently supported in mobileTWS for Android, iPhone and iPad. To enable in TWS, from the Lock and Exit section of Global Configuration ensure that Save watchlists to cloud is checked. This setting is checked by default.

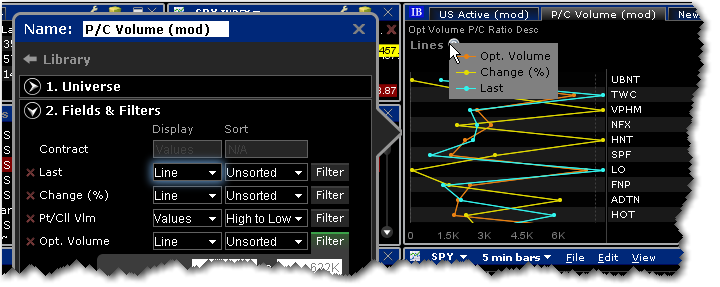

Line Chart for Mosaic Market Scanner

In addition to the gradient, bar, value and combination selections in the Mosaic Market Scanner, you can now also select "Line" to display a line chart as the value display. Gradients, bars and lines give users the ability to quickly peruse a list of scanner results and easily identify contracts with interesting properties without needing to read individual rows of values. Add value gradients, lines and bars from the "Fields" selection area of the scanner setup wizard. In the Display field for an entry, click to show the available selections.

The Line chart displays the field value graphically using a colored line. You can elect to view up to three fields using the Line chart view. Mouse over the "Lines ?" display in the scanner to see the key to the Line colors.

In addition you can select:

- Values + Line - Displays the numerical value plus the graphical line chart indicator.

- Values + Gradient - Displays the numerical value plus the graphical indicator.

- Values + Bar - Displays the numerical value plus the graphical bar indicator.

- None - Includes the field but does not display a field value.

Sort Enhancement for Position Field

The ability to sort by ascending or descending absolute value (10, -12, -15, 22 etc) has now been enabled for the Position field which can be added to many tools including the Quote Monitor and Portfolio window. You can change the sort type using the right-click menu, or by clicking the field title multiple times to cycle through sort types in order (no sort, descending order, ascending order, descending by absolute value, ascending by absolute value). Each sort type is identified by an icon; ascending and descending use upward and downward pointing arrows respectively, and ascending and descending absolute value use upward and downward pointing arrows with border lines, respectively. Current fields that support this sort types include:

- Position

- %Change (used in Top % Gainers scan)

- %Change Since Open (used in Top % Gainers Since Open scan)

- %Gap (used in Top Close-To-Open % Gainers scan)

- ImpVol %Change (used in Top Option Imp Vol % Gainers scan)

- ImpVol vs Hist (used in High Option Imp Vol Over Historical scan)

- Growth (used in High Growth Rate scan)

- ROE (used in High Return On Equity scan)

Unreported Last in Time & Sales

The "Last" price for trades that occur under certain circumstances such as being part of a spread trade, a trade reported late, or some other special condition trade, are not shown in TWS market data, but by default will now be displayed in Time & Sales for the underlying. These "unreported last" ticks are identified in Time and Sales by a yellow tick dot.