Rebalance Your Portfolio

Rebalance Your Portfolio

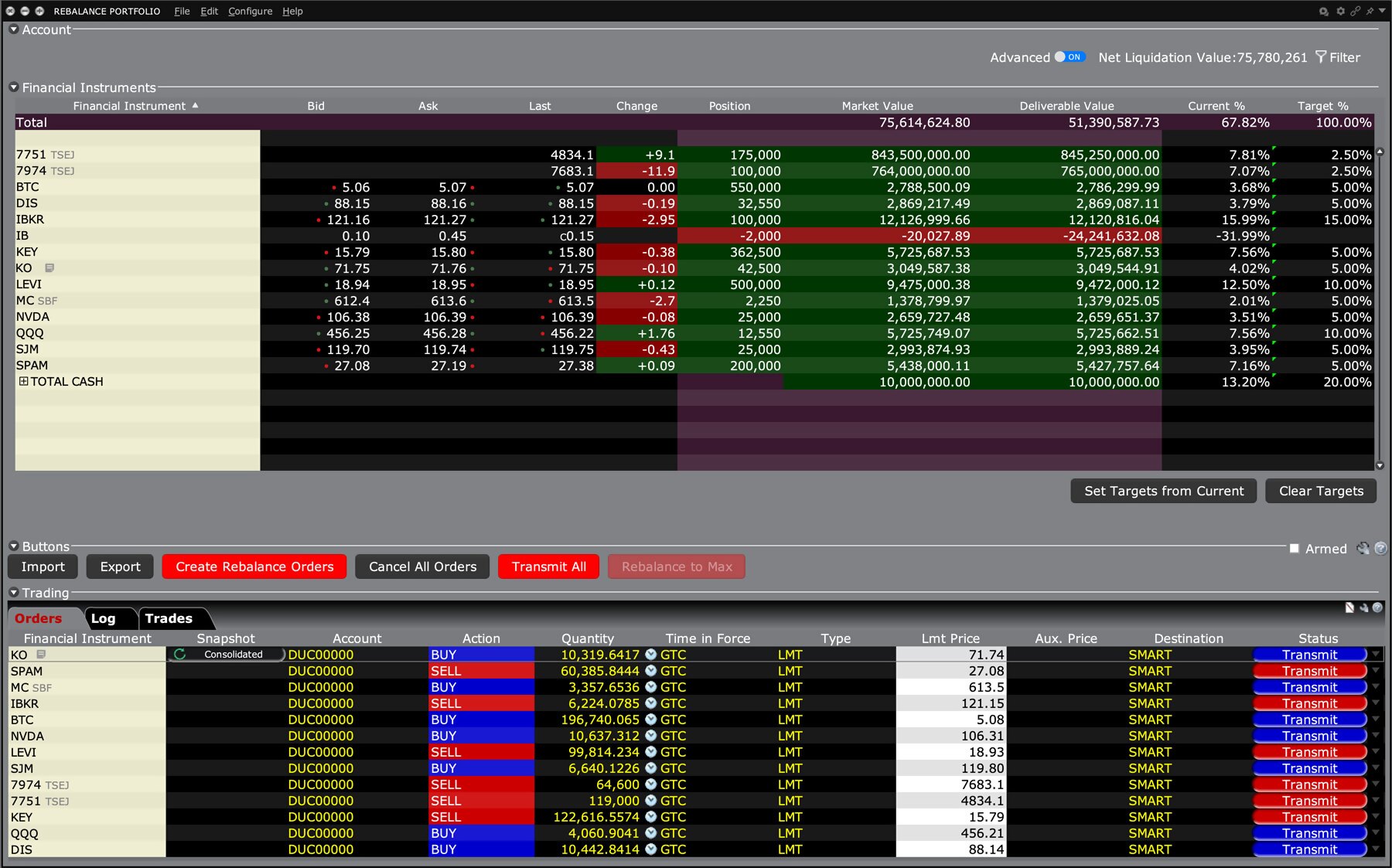

The Rebalance Portfolio tool can help you retain control of your portfolio and create a risk profile that suits you whether you are a sophisticated trader or an advisor administering a number of client accounts.

Use the Rebalance Portfolio tool to redistribute the current position weighting in your portfolio. Specify a new "Target Percentage" for your positions and let TWS automatically create orders that, when submitted, will attempt to execute trades to keep your portfolio in line with your investment strategy.

Using the Tool

Open Rebalance Portfolio

- From Mosaic: Use the New Window dropdown and navigate to Advanced Trading Tools > More Advanced Tools, and then select Rebalance Portfolio.

- From Classic TWS: Use the Trading Tools menu and from the Multi Contract section select Rebalance Portfolio.

Understanding the Interface

Account

Use the Account panel to determine the account or group of accounts that will be affected by the rebalance portfolio process. Individual users will see their single account. Advisors and other multi-account users will have an Account drop down selector where they can choose all accounts, choose one account, or create a group with specific accounts included, and then select the group.

Contracts Panel

Use the Contracts panel to change the position weighting of individual positions in your portfolio.

- Set Targets From Current – This button will resets the target percentages to use the actual percentage values.

- Clear Targets – This button clears all values in the target percentages column and saved targets.

Buttons Panel

Check the "Armed" checkbox to transmit orders instantaneously when you click the Transmit All button. Otherwise you will received a confirmation message before all orders are transmitted. Other buttons allow you to:

- Import – Migrates contract row data to the contracts panel.

- Export – Exports all existing rows to a .CSV file.

- Create Rebalance Orders – creates orders to execute the model. Send orders from the Orders tab in the Trading panel at the bottom of the tool.

- Rebalance to Max – Creates rebalance orders based on max percentages.

- Cancel All Orders – Immediately discards all un-submitted orders and cancels all working orders in the Orders panel.

- Transmit All – When the tool is "armed" this button will immediately transmit all rebalance orders from the Order panel. When unarmed, you will receive a confirmation message asking if you want to submit all orders.

Trading Panel

The Trading panel lets you see all un-submitted orders, trades and trade logs.

Rebalance Positions

Define Target Percentages

For each position, reset the Target% until the weighting of all positions meets your desired amount. You may also open positions at this time by simply entering a contract symbol into a blank row as you would in the main trading window.

Select Create Rebalance Orders to have the system automatically model the new portfolio structure. A trading panel will display the order details. Modify the order parameters as needed and transmit the orders. Selecting Transmit All will execute all orders specified by the Rebalance Portfolio. Click Cancel All Orders to cancel your submitted orders and discard un-transmitted orders.

USER GUIDES

Get Started with the Rebalance Portfolio Tool

For more information on the Rebalance Portfolio tool, select your trading platform.