Options Margin Requirements

Options Margin Overview

Europe Options Margin Requirements

For residents of Europe trading options:

- Rules-based margin

- Risk-based margin

The complete margin requirement details are listed in the sections below.

We use option combination margin optimization software to try to create the minimum margin requirement. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. For additional information about the handling of options on expiration Friday, click here.

Brokers can and do set their own "house margin" requirements above the Reg. T or statutory minimum. For option spreads in VIX securities, we may charge an additional minimum house margin requirement of USD 150. For option positions that meet the definition of a "universal" spread under CBOE Rule 10.3(a)(5), we may charge an additional house requirement of 102% of the net maximum market loss associated with the spread (i.e., net long option position price – net short option position price * 102%), if greater than the statutory requirement.

Option Strategies

The following tables show option margin requirements for each type of margin combination.

Note:

These formulas make use of the functions Maximum (x, y, ..), Minimum (x, y, ..) and If (x, y, z). The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. As an example, Maximum (500, 2000, 1500) would return the value 2000. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. As an example, Minimum (500, 2000, 1500) would return the value of 500. The If function checks a condition and if true uses formula y and if false formula z. As an example If (20 < 0, 30, 60) would return the value 60.

Note: Clients must have an account net liquidation value of at least 2,000 USD to establish or increase an existing uncovered options position.

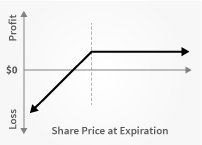

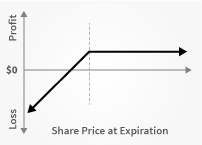

Long Call or Put

| Margin | |

| Initial/RegT End of Day Margin | None |

| Maintenance Margin | Same as Initial |

| Cash or IRA Cash | Same as Initial |

| IRA Margin | Same as Margin Account |

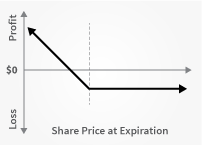

Short Naked Call

| Margin | |

| Initial/RegT End of Day Margin |

Stock Options 1 Call Price + Maximum ((20% 2 * Underlying Price - Out of the Money Amount), (10% * Underlying Price)) Index Options 1 Call Price + Maximum ((15% 3 * Underlying Price - Out of the Money Amount), (10% * Underlying Price)) World Currency Options 1 Call Price + Maximum ((4% 2 * Underlying Price - Out of the Money Amount), (0.75% * Underlying Price)) Cash Basket Option 1 In the Money Amount |

| Maintenance Margin | Same as Initial |

| Cash or IRA Cash | N/A |

| IRA Margin | Same as Cash Account |

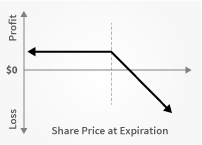

Short Naked Put

| Margin | |

| Initial/RegT End of Day Margin |

Stock Options 1 Put Price + Maximum ((20% 2 * Underlying Price - Out of the Money Amount), (10% * Strike Price)) Index Options 1 Put Price + Maximum ((15% 3 * Underlying Price - Out of the Money Amount), (10% * Strike Price)) World Currency Options 1 Put Price + Maximum ((4% 2 * Underlying Price - Out of the Money Amount), (0.75% * Underlying Price)) Cash Basket Option 1 In the Money Amount |

| Maintenance Margin | Same as Initial |

| Cash or IRA Cash | Put Strike Price |

| IRA Margin | Same as Cash Account |

Covered Calls

Short an option with an equity position held to cover full exercise upon assignment of the option contract.

| Margin | |

| Initial/RegT End of Day Margin | Max(Call Value, Long Stock Initial Margin) |

| Maintenance Margin | MAX[In-the-money amount + Margin(long stock evaluated at min(mark price, strike(short call))), min(stock value, max(call value, long stock margin))] |

| Cash or IRA Cash | Stock paid in full or None |

| IRA Margin | Stock paid in full or None |

Covered Puts

Short an option with an equity position held to cover full exercise upon assignment of the option contract.

| Margin | |

| Initial/RegT End of Day Margin | Initial Stock Margin Requirement + In the Money Amount |

| Maintenance Margin | Initial Stock Margin Requirement + In the Money Amount |

| Cash or IRA Cash | N/A |

| IRA Margin | N/A |

Call Spread

A long and short position of equal number of calls on the same underlying (and same multiplier) if the long position expires on or after the short position.

| Margin | |

| Initial/RegT End of Day Margin | Maximum (Strike Long Call - Strike Short Call, 0) |

| Maintenance Margin | Same as Initial |

| Cash or IRA Cash | Same as Initial if both options are European-style cash-settled Otherwise, N/A. |

| IRA Margin | Same as Margin Account |

Put Spread

A long and short position of equal number of puts on the same underlying (and same multiplier) if the long position expires on or after the short position.

| Margin | |

| Initial/RegT End of Day Margin | Maximum (Short Put Strike - Long Put Strike, 0) |

| Maintenance Margin | Same as Initial |

| Cash or IRA Cash | Same as Margin Account (Both options must be European style cash settled) Short Put Strike Price (American style options) |

| IRA Margin | Same as Margin Account |

Collar

Long put and long underlying with short call. Put and call must have same expiration date, same underlying (and same multiplier), and put exercise price must be lower than call exercise price.

| Margin | |

| Initial/RegT End of Day Margin | Initial Stock Margin Requirement + In the Money Call Amount Equity with Loan Value of Long Stock Minimum (Current Market Value, Call Aggregate Exercise Price) |

| Maintenance Margin | Minimum (((10% * Put Exercise Price) + Out of the-Money Put Amount), (25% * Call Exercise Price)) |

| Cash or IRA Cash | None |

| IRA Margin | None |

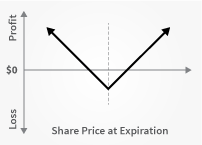

Long Call and Put

Buy a call and a put.

| Margin | |

| Initial/RegT End of Day Margin | Margined as two long options. |

| Maintenance Margin | Same as Initial |

| Cash or IRA Cash | Same as Margin Account |

| IRA Margin | Same as Margin Account |

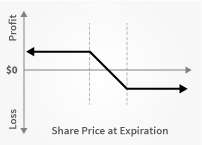

Short Call and Put

Sell a call and a put.

| Margin | |

| Initial/RegT End of Day Margin |

If Initial Margin Short Put > Initial Short Call, then Initial Margin Short Put + Price Short Call else If Initial Margin Short Call >= Initial Short Put, then Initial Margin Short Call + Price Short Put |

| Maintenance Margin | Same as Initial |

| Cash or IRA Cash | N/A |

| IRA Margin | N/A |

Long Butterfly

Two short options of the same series (class, multiplier, strike price, expiration) offset by one long option of the same type (put or call) with a higher strike price and one long option of the same type with a lower strike price. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal.

| Margin | |

| Initial/RegT End of Day Margin | None |

| Maintenance Margin | Same as Initial |

| Cash or IRA Cash | None Both options must be European-style cash-settled. |

| IRA Margin | Same as Margin Account |

Short Butterfly Put

Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal.

| Margin | |

| Initial/RegT End of Day Margin | MAX(Highest Put Strike - Middle Put Strike, 0) + MAX(Lowest Put Strike - Middle Put Strike, 0) |

| Maintenance Margin | Same as Initial |

| Cash or IRA Cash | N/A |

| IRA Margin | N/A |

Short Butterfly Call

Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal.

| Margin | |

| Initial/RegT End of Day Margin | MAX(Middle Call Options Strike - High Call Options Strike, 0) + MAX(Middle Call Options Strike - Lowest Call Option Strike, 0) |

| Maintenance Margin | Must maintain initial margin. |

| Cash or IRA Cash | N/A |

| IRA Margin | N/A |

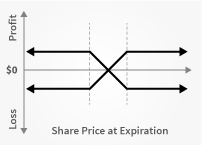

Long Box Spread

Long call and short put with the same exercise price ("buy side") coupled with a long put and short call with the same exercise price ("sell side"). Buy side exercise price is lower than the sell side exercise price. All component options must have the same expiration, and underlying (multiplier).

| Margin | |

| Initial/RegT End of Day Margin | None |

| Maintenance Margin | Same as Initial |

| Cash or IRA Cash | N/A |

| IRA Margin | Same as Margin Account |

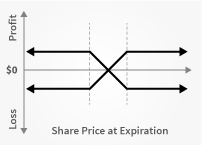

Short Box Spread

Long call and short put with the same exercise price ("buy side") coupled with a long put and short call with the same exercise price ("sell side"). Buy side exercise price is higher than the sell side exercise price. All component options must have the same expiration, and underlying (multiplier).

| Margin | |

| Initial/RegT End of Day Margin | MAX(1.02 x cost to close, Long Call Strike – Short Call Strike) |

| Maintenance Margin | Same as Initial |

| Cash or IRA Cash | N/A |

| IRA Margin | Same as Margin Account |

Conversion

Long put and long underlying with short call. Put and call must have the same expiration date, underlying (multiplier), and exercise price.

| Margin | |

| Initial/RegT End of Day Margin | Initial Stock Margin Requirement + In the Money Call Amount |

| Maintenance Margin | 10% of the strike price + In the Money Call Amount |

| Cash or IRA Cash | N/A |

| IRA Margin | N/A |

Reverse Conversion

Long call and short underlying with short put. Put and call must have same expiration date, underlying (multiplier), and exercise price.

| Margin | |

| Initial/RegT End of Day Margin | In the Money Put Amount + Initial Stock Margin Requirement |

| Maintenance Margin | In the Money Put Amount + (10% * Strike Price) |

| Cash or IRA Cash | N/A |

| IRA Margin | N/A |

Protective Put

Long Put and Long Underlying.

| Margin | |

| Initial/RegT End of Day Margin | Initial Stock Margin Requirement |

| Maintenance Margin | Minimum (((10% * Put Strike Price) + Put Out of the Money Amount), Long Stock Maintenance Requirement) |

| Cash or IRA Cash | None |

| IRA Margin | None |

Protective Call

Long Call and Short Underlying.

| Margin | |

| Initial/RegT End of Day Margin | Initial Standard Stock Margin Requirement |

| Maintenance Margin | Minimum (((10% * Call Strike Price) + Call Out of the Money Amount), Short Stock Maintenance Requirement) |

| Cash or IRA Cash | N/A |

| IRA Margin | N/A |

Iron Condor

Sell a put, buy put, sell a call, buy a call.

| Margin | |

| Initial/RegT End of Day Margin | Short Put Strike - Long Put Strike |

| Maintenance Margin | Same as Initial |

| Cash or IRA Cash | If all options are European and cash-settled, same as margin account. |

| IRA Margin | Same as Margin Account |

Risk Margin Overview

What is risk based margining?

A risk based margin system evaluates your portfolio to set your margin requirements. The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. As a result, a more accurate margin model is created, allowing the investor to increase their leverage.

How are correlated risks offset?

Within a group of positions with the same underlying, 100% of the gain at any one valuation point is allowed to offset another positions loss at the same valuation point.

Example: An account holds a long stock position in stock ABC and a long put option contract in ABC. If a theoretical worst case scenario causes the underlying asset to drop 15%, then the loss that on the long stock position would be offset by the gain on the long put position.

What are my eligibility requirements?

Eligibility requirements vary according to the investor's personal information, region, and exchange.

What positions are eligible?

All positions in margin equity securities (including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures.

Additional Europe Margin Requirements

For Residents of Europe:

Use the following links to view other margin requirements:

You can change your location setting by clicking here

Disclosures

- IBKR house margin requirements may be greater than rule-based margin.