DepthTrader

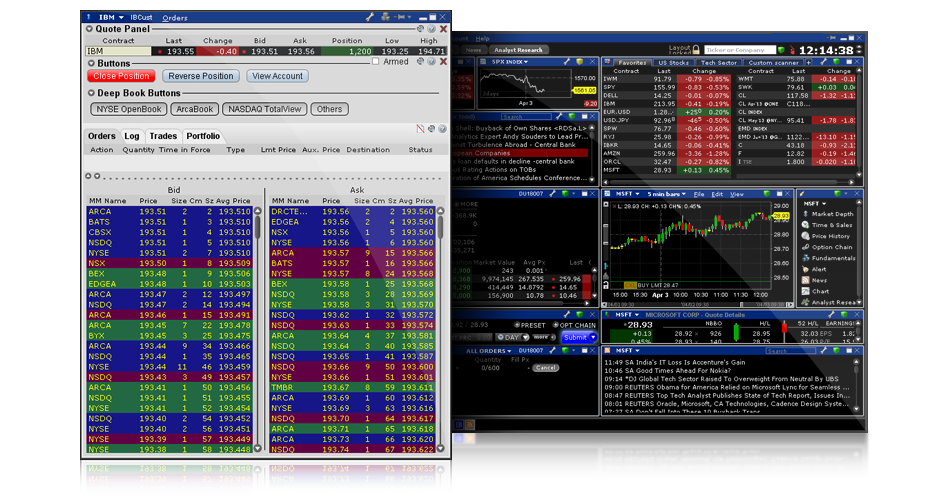

Take a closer look at market liquidity with Trader Workstation's Market Depth.

The aggregated Market Depth window lets you better gauge market liquidity by displaying the alternative bids and offers away from the inside quote. Market Depth is an independent, yet totally integrated TWS component that facilitates large volume trades using cumulative quantities and average execution price available at a particular price or better.

TWS Market Depth offers traders the following benefits:

- Color-coded for instant recognition.

- Access Level II data by subscription.

- Display Level I data from exchanges that don't offer deep data, for which you don't have market data permissions, or to which you subscribe but haven't selected.

- Quickly create, modify and transmit orders.

- Create an opposite side order with sufficient quantity to reverse your position from long to short or short to long.

- Automatically create an opposite side closing order.

- Configure the Market Depth window to suit your own preferences.