Mosaic Spread Builder for Options Combos

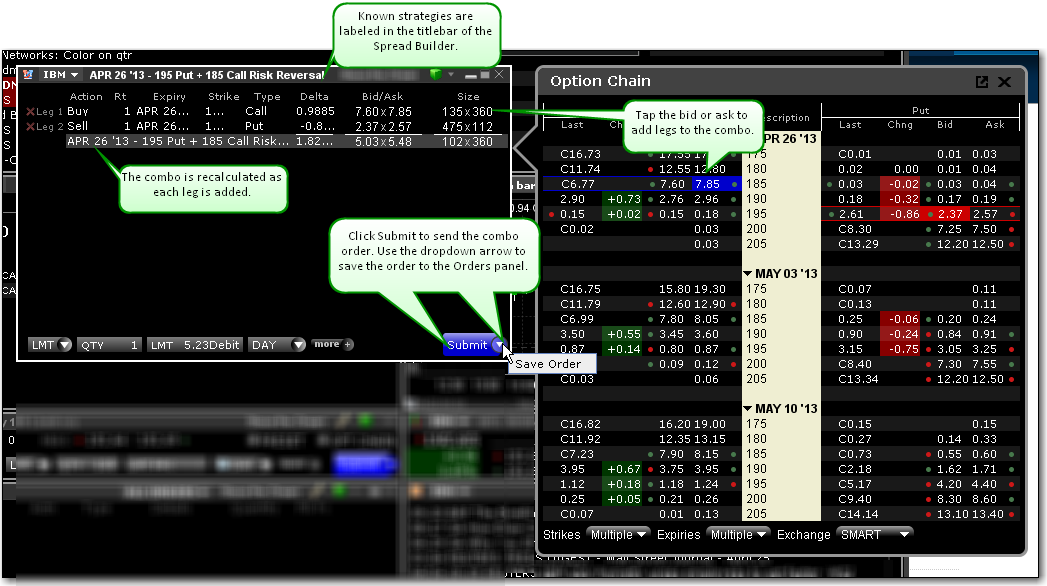

The options Spread Builder allows you to quickly create option spreads within the option chain by clicking the bid or ask price of the desired options to add them as legs. Access Spread Builder from within Mosaic by selecting New Window, and then Spread Builder in the Trade section of the New Window list. Follow the prompts to specify an underlying and then click the Bid or Ask price of an option in the chain to add it to the Spread Builder as a leg. As each leg is added, the Spread Builder creates the combo order. When completed, you can elect to either submit the order, or use the dropdown arrow on the Submit button to save the spread order to the Mosaic Orders panel to submit at a later date.

You can also enable the Spread Builder from within the Option Chain window by clicking the Spread Builder title at the bottom right of the Option Chain tool.