Accumulate/Distribute Algo

Accumulate / Distribute

A robust, customizable algo that gives you complete control of order management.

Already a Client?

Try it in

Desktop TWS

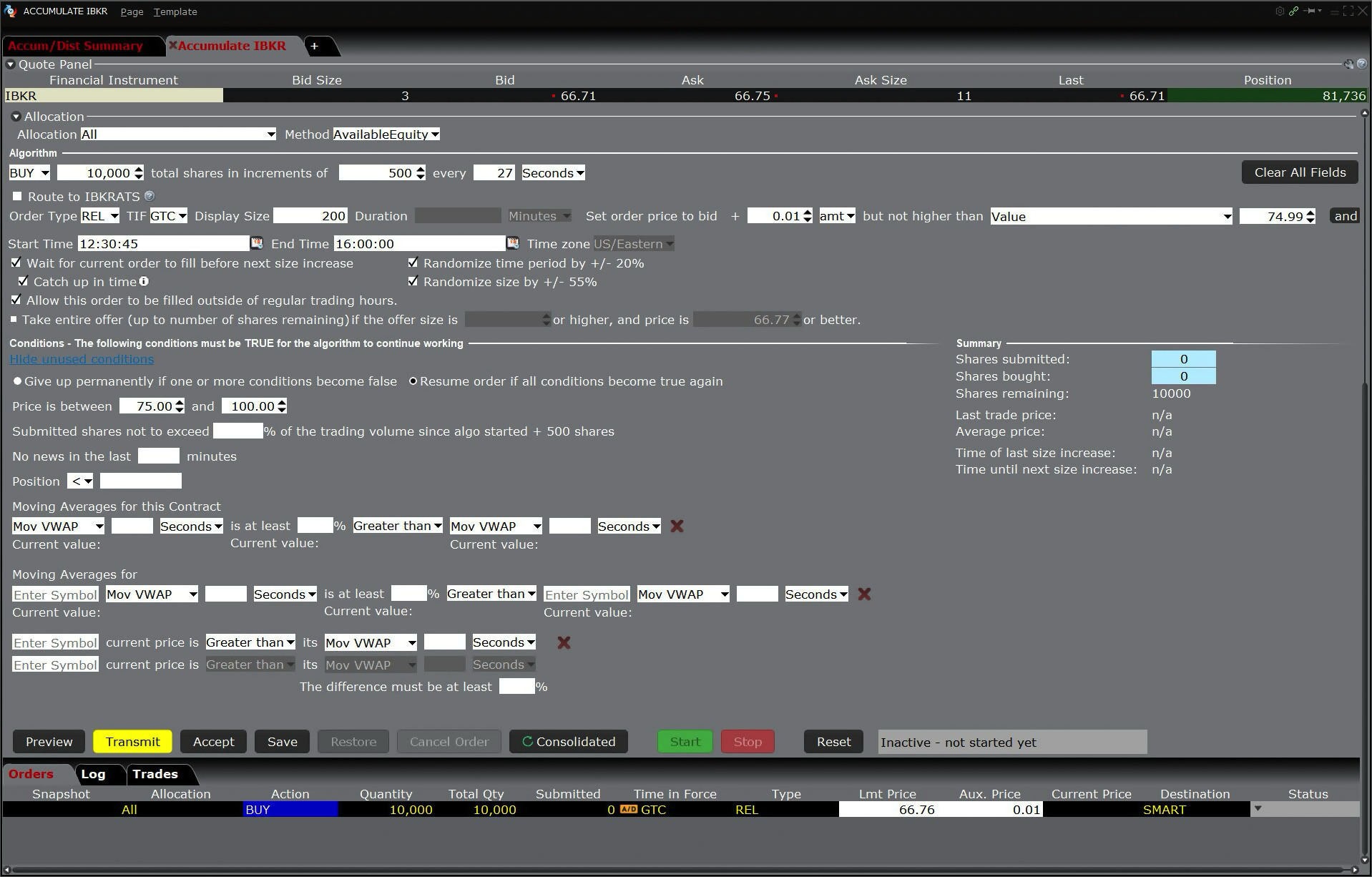

Simple or Sophisticated? It’s Dealer’s Choice

Move through the strategy checkboxes to decide how simple or complex to make your algo. You can define a limited set of simple features with a basic order type and submit, or mix things up by choosing a more complex order type and defining conditions and strategies that must be met for the order to continue. This algo also provides access to the IBKR ATS to help you execute trades discreetly.

Trade like a Team

The Accumulate/Distribute algo gives one trader the power of a team. The comprehensive algo interface allows a single trader to easily create, submit, and manage multiple large volume orders simultaneously.

Be Unpredictable

Once you define the baseline for slicing the full order into smaller increments and submitting them at specific time intervals, you can apply randomization to make your large order behave like a series of unrelated small orders. Use the algo checkboxes to randomize increment size, the time period for submitting increments and more.

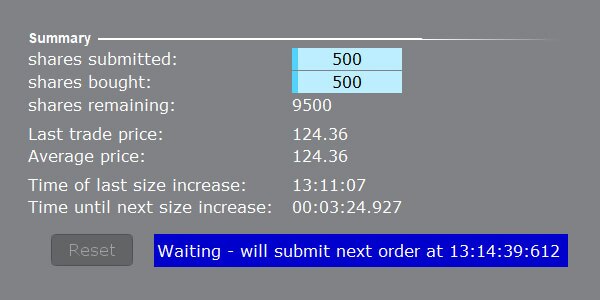

Progress at a Glance

Each order runs on its own tab. Click a tab and check the Summary section to quickly see how your algo order is progressing. Use the Start and Stop buttons to pause and resume the algo as needed.

One Algo Has It All

IBKR’s Accumulate/Distribute algo slices your large order into smaller, non-uniform increments and releases them at random intervals over time. It can help to achieve the best price for your large volume orders without being noticed in the market, and the robust interface allows a single trader to easily and effectively manage multiple large volume orders simultaneously.

Already a Client?

Try it in

Desktop TWS

Try it in

Desktop TWS

USER GUIDES

Get Started with Accumulate/Distribute

For more information on using the Accumulate/Distribute algo, select your trading platform.