Sweep-to-Fill Orders

Sweep-to-fill orders are useful when a trader values speed of execution over price. A sweep-to-fill order identifies the best price and the exact quantity offered/available at that price, and transmits the corresponding portion of your order for immediate execution. Simultaneously it identifies the next best price and quantity offered/available, and submits the matching quantity of your order for immediate execution.

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| CFDs |  |

US Products |  |

Smart |  |

Attribute |  |

| Stocks |  |

Non-US Products |  |

Directed |  |

Order Type |  |

| Warrants |  |

Time in Force |  |

||||

| Open Users' Guide | |||||||

Example

Order Type In Depth - Sweep-to-Fill Buy Order

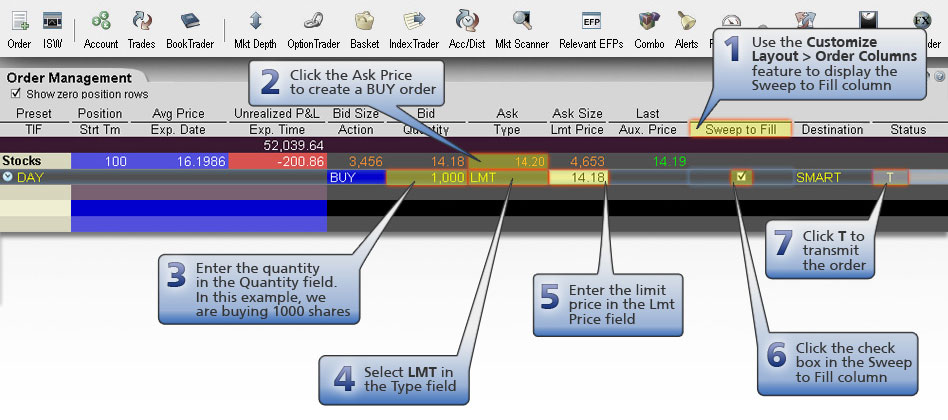

Step 1 – Enter a Sweep-to-Fill Buy Order

XYZ is trading at $14.18 - $14.22. You want to buy 1000 shares as quickly as possible before the company issues their earnings report, so you decide to place a sweep-to-fill limit order. To do this, first display the Sweep to Fill order column on the trading screen. Next, create a BUY order, select LMT in the Type field and enter 1000 in the Quantity field. Set your limit price to $14.22, and select the checkbox in the Sweep-to-Fill column to indicate that this is a sweep-to-fill order. Transmit the order.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 1000 |

| Order Type | LMT |

| Sweep to Fill | Selected |

| Market Price | $14.18 - $14.22 |

| Limit Price | $14.22 |

Step 2 – Order Transmitted

The order is working. Destination A offers 200 shares at an ask price of $14.18/share. Destination B offers 400 shares at an ask price of $14.19/share, and Destination C offers 400 shares at $14.20/share.

Step 3 – Order Fills at Multiple Destinations

Your sweep-to-fill order for 1000 shares of XYZ stock is split into multiple components and simultaneously sent to three destinations that are offering the required quantity. All three components fill at the specified limit price or better:

- 200 shares fill immediately at Destination A for $14.18

- 400 shares fill immediately at Destination B for $14.19

- 400 shares fill immediately at Destination C for $14.20

| Results | |

|---|---|

| Action | BUY |

| Qty | 1000 |

| Order Type | LMT + Sweep-to-Fill |

| Limit Price | $14.22 |

| Destination A | |

| Fill Price | $14.18 |

| Filled Quantity | 200 |

| Destination B | |

| Fill Price | $14.19 |

| Filled Quantity | 400 |

| Destination C | |

| Fill Price | $14.20 |

| Filled Quantity | 400 |