Basket Orders

TWS BasketTrader can be used to manage baskets of securities or other asset classes and automatically create and maintain a customizable index-based basket. Portfolio managers and investors can build a spreadsheet of tickers for import to TWS or simply add directly to a TWS page. Order size and type and price can be built before saving the entire group as a Basket for execution at a later time. Because BasketTrader is flexible and configurable, investors can quickly access an established portfolio, rebalance and manage baskets before submitting orders. Use the stand-alone IndexTrader application to create and manage only index-based baskets.

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| Bonds |  |

US Products |  |

Smart |  |

Attribute |  |

| Funds |  |

Non-US Products |  |

Directed |  |

Order Type |  |

| Futures |  |

Time in Force |  |

||||

| FOPs |  |

Order File |  |

||||

| Options |  |

||||||

| Stocks |  |

||||||

| Warrants |  |

||||||

| CFDs |  |

||||||

| Forex |  |

||||||

| View Supported Exchanges|Open Users' Guide | |||||||

TWS BasketTrader Part 1 – Create a Basket Short Video

Your capital is at risk.

Interactive Brokers (U.K.) Limited is authorised and regulated by the Financial Conduct Authority.

TWS BasketTrader Part 2 – Upload a Basket Short Video

Your capital is at risk.

Interactive Brokers (U.K.) Limited is authorised and regulated by the Financial Conduct Authority.

Example

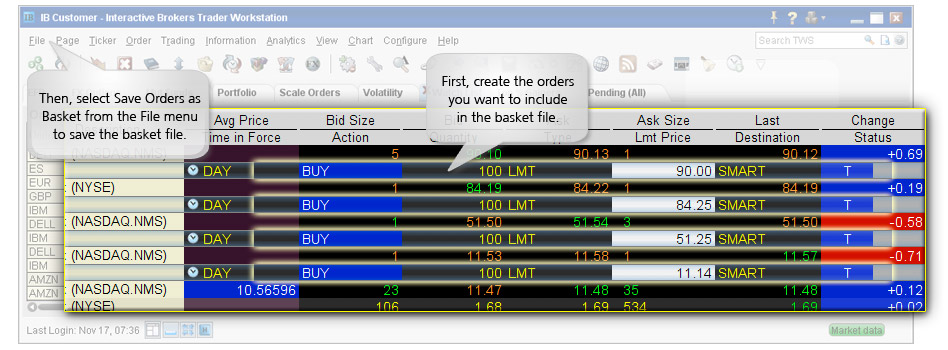

You want to place a group of orders for a number of different instruments at one time. Before you can select and transmit your basket order, you must create and save the basket file:

First, create orders to include in the basket file. Modify the order parameters and define the order attributes as required. Next, on the Trade menu, select Save Orders as Basket. In the dialog box, review or rename the file using a .csv extension (for example, stocks.csv) then click OK. The system uses the Trading page name as the default basket name. Now cancel the orders you created by selecting Cancel Page from the Trade menu.

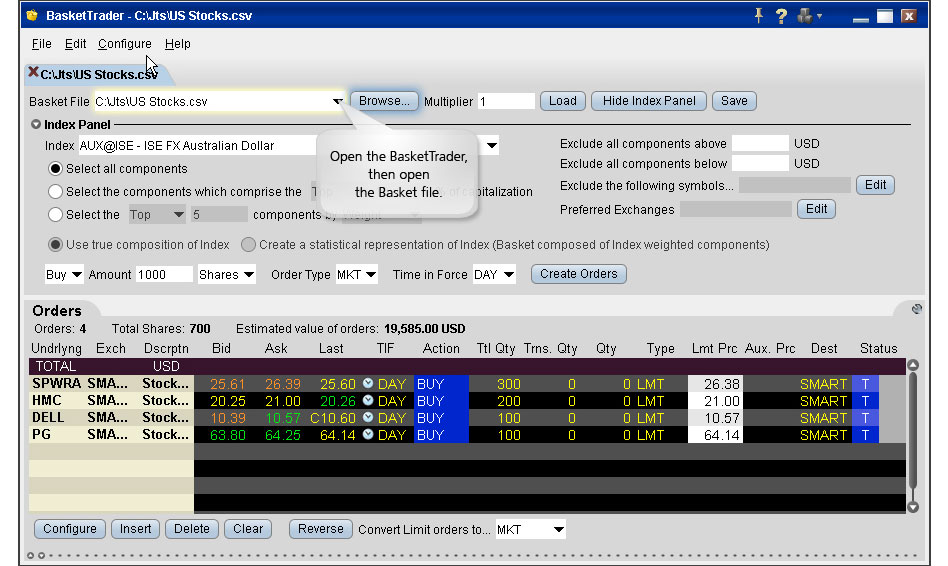

Next, place your basket order using the BasketTrader. On the Trading Tools menu, select BasketTrader, or click the Basket icon on the trading toolbar. In the Basket File field, select a basket file from the list or click the Browse button to find a basket file that doesn't appear in the list. Modify the Multiplier if necessary. This value multiplies the quantity of each order in the basket. Modify the order parameters if necessary, then submit the entire basket order. You can submit individual orders within the basket using the market data lines on the Orders tab.

A single Basket order can contain multiple order types on various products, and include any supported time in force or order attribute. The image below shows a limited sample of a basket order file that has been opened in MS Excel.