Pre-Borrow Program

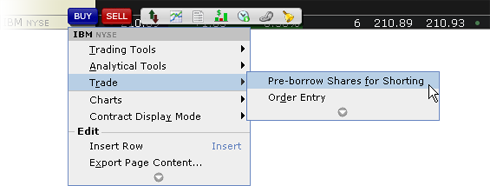

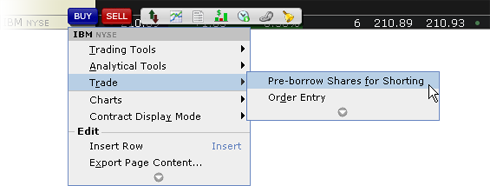

Our Pre-Borrow Program for US Stocks is now available to Portfolio Margin customers. Once you have registered, this program lets you pre-borrow stocks in anticipation of a short sale using the Stock Borrow/Loan page in TWS. Pre-borrowing can help to avoid a buy-in by ensuring that shares are available to short before you put on the short sale. Without a pre-borrow, you will not know for certain if shares have been procured until the short sale settles on T+3.

The Pre-Borrow Program offers these benefits:

- Decreases buy-in risk for customers who want to short.

- Lock in a locate that only your account can use to sell short.

- Provides access to all of IB's stock loan relationships.

- IB's Stock Loan Desk manages the borrow for you.

Keep the following guidelines in mind when participating in our Pre-Borrow Program:

- The program is available for Portfolio Margin accounts only.

- Sign up for the program on the Trading Permissions page in Account Management.

- You will pay additional borrow fees for any pre-borrowed shares held in excess.

- The Pre-Borrow Program assumes that shares are borrowed first and the short sale is executed second. If this doesn't happen AND you are already short that underlying, the pre-borrow will be applied to the existing short on the following day.

- The rate on the trade displayed in Trader Workstation is the indicative rate only. You will be charged the standard borrow rate, which is computed at the end of the day and will be displayed on your Activity Statement.

- If no short trade is put on by the fourth day after the pre-borrow, it becomes a non-purpose borrow and the shares are returned.

- Once you pre-borrow, shares available for shorting are displayed in the Private Locate field in the TWS Stock Borrow/Loan window.