Model Portfolios

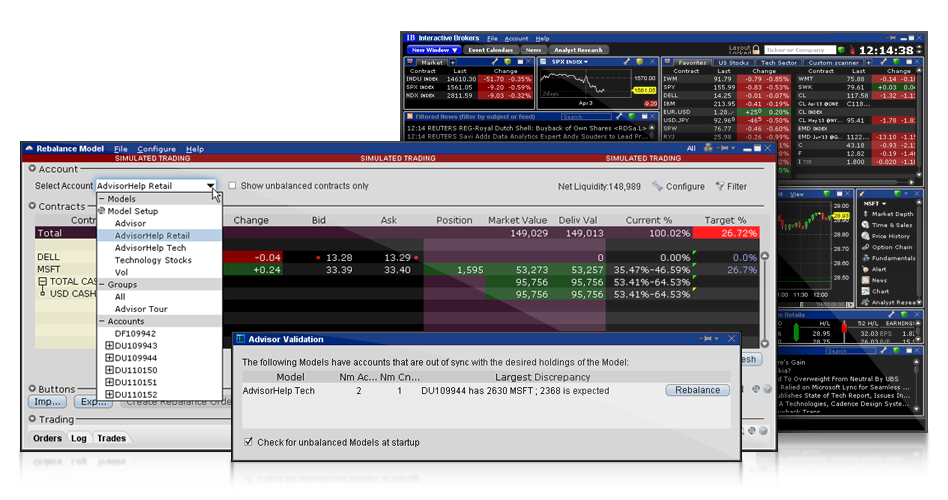

TWS Model Portfolios offer Advisors an efficient, time-saving and more organized approach to investing client assets.

Models allow Advisors to create groupings of financial instruments based on specific investment themes and invest client funds into the Model, rather than taking time to invest in multiple, single instruments.

Model Portfolios simplify the tasks of managing and investing multiple client accounts by allowing advisors to:

- Manage multiple trading strategies for each client without requiring their clients to open multiple IB accounts.

- Quickly and automatically allocate investments from multiple client accounts into a single Model.

- Spend more time focusing on client services and less time making individual trades.

- Use Model Portfolios like mutual-funds but without the tax considerations of mutual funds.

- Advisors can specify positions of greater than 100% when allocating client funds to a model portfolio employing leverage as desired.

A Model Portfolio can invest in stocks and single leg positions.